Hybrid work and digital transformation in financial services

Financial services (FS) are on a digital transformation journey. However, before COVID-19, this journey focused mainly on customers, moving their activities from in-person to online.

Over the past year and a half, the digital transformation priority shifted. Now FS professionals are looking internally and prioritizing employee practices. With the rapid adoption of hybrid work, this digital transformation has never been timelier, and it is centering around the tech stack.

Prioritizing business enablement solutions allows FS organizations to seamlessly adjust to hybrid work while also improving internal efficiencies and reducing operational costs.

Financial services remote work reality

The FS industry is document-heavy. Employees spend their days’ building client deliverables, contracts, emails, presentations, the list goes on. In a remote world filled with ever-changing industry regulations, rules and formats, this creation process became even more complicated.

According to a recent survey from PwC, just 20% of financial services employees said that collaborating on new projects was better than pre-COVID-19. This can be partly attributed to disconnected tech stacks.

71% of employees are spending up to six hours a week consolidating and tracking down information, and more than a quarter feel the number of tools they must use to do their work decreases the amount of work they can complete on any given day.

To increase efficiency and productivity across a hybrid workforce, business leaders must focus on fixing this problem.

A tech stack driven by content enablement

Today’s fragmented tech stacks result from piecing together several different technologies without proper (or any) integration. It means that information transfer and sharing between tools is limited at best.

The next frontier of financial services digital transformation is centered around solving this problem. Employees need a tech stack that allows them to work more effectively, no matter if they’re in the office or working remotely.

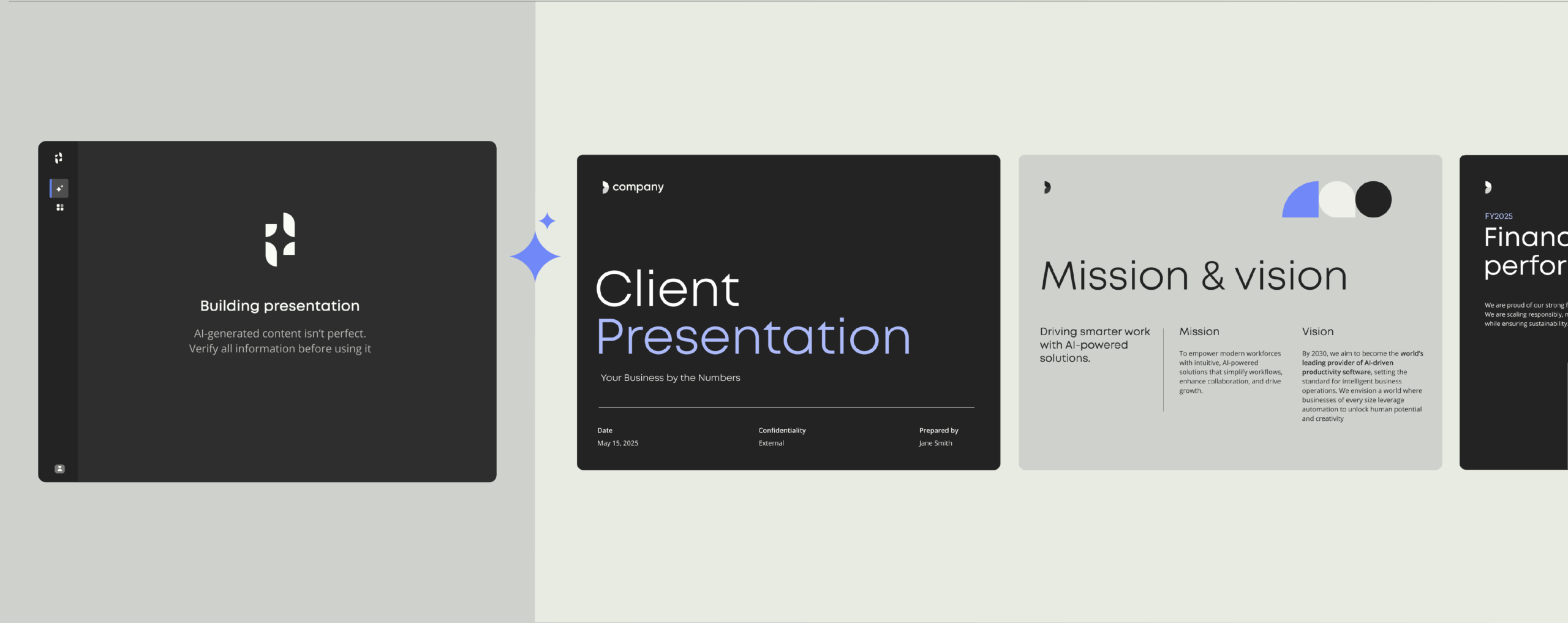

The key to this solution relies on content enablement. A content enablement platform is an infrastructure connecting content stored across all company systems directly to people. It provides seamless workflows that bring content directly to the employees when and where they need it as they create business content. The efficiency of the workflow significantly cuts time spent on creating, collaborating and finalizing documents, allowing employees to get work done faster and more efficiently.

Take a multinational accounting firm. Employees are located throughout different regions meaning there are localized regulations and rules to follow. The knowledge of these rules is what clients are paying for, but it can be extremely time-consuming for employees to stay on top of. And not to mention the massive risk incurred if any document makes it out the door without the correct disclaimer or regulation adherence.

A content enablement platform mitigates this risk by automatically connecting the correct content to the employee. Using smart automation, employees generate proposals and other business-critical documents quickly using only company governed content while also giving organizations the ability to track performance.

The result is increased workplace efficiency and automatic compliance while cutting out repetitive work in document creation.

Encouraging innovation with content enablement

New financial services digital transformation changes influenced by the hybrid work movement will not only allow employees to be more productive and efficient regardless of their location but also foster more innovation.

Financial services leaders are already being challenged to innovate while moving more into the digital space. This has manifested with three major focus areas:

- Figuring out how to make a business run more efficiently today;

- Figuring out the future of a business;

- Keeping a finger on the pulse of regulation and how that will impact today and tomorrow.

To adequately do all these things, financial services professionals need tools that allow them to focus less on administrative components and more on tangible value adds.

Content enablement solutions foster this innovation by allowing employees to focus on doing their best work while easily compiling on-brand, compliant proposals quickly.

Financial services professionals who can prioritize transforming their tech stack through content enablement solutions will come out ahead in the hybrid work era. These solutions create a smooth workflow regardless of location, allow employees to create high-value innovative work, and cut down on risk and operational costs across an organization.

It’s time for financial services leaders everywhere to recognize how the business tech stack will digitally transform the future of work.

summary

Content enablement platforms empower Financial Services professionals by:

- Increasing workflow efficiency

- Granting easy access to all relevant templates and content

- Providing the freedom to focus on innovative work instead of administrative