AI auditing software: Which tools and use cases promise the best ROI?

How to choose the right tool and roll it out safely and smoothly

Let’s face it: computers are better at reading numbers than we are. That’s why your teams—whether they’re part of an in-house audit department or an external audit firm—already use a stack of tools to carry out audits. Data analytics software tools and workflow management platforms are probably already part of your workflow.

Now, a new wave of AI-powered accounting tools is promising to take over the manual, repetitive parts of auditing for good.

But choosing the right AI tool—and rolling it out properly—isn’t simple. In an industry built on quality, accuracy, and compliance, you’ll need strong governance, a clear strategy, and a solid plan to manage risks.

We’ve pulled together everything you need to know to choose the right AI auditing software and deploy it safely and successfully.

Top stats for AI in auditing

- 72% of companies are already using or testing AI in financial reporting. (KPMG)

- By 2027, 99% of companies are expected to adopt AI auditing tools. (KPMG)

- AI saves five hours per week for tax and audit professionals. (Thomson Reuters)

Why AI auditing software matters

Manual tasks like data extraction, sampling, and reconciliation eat up a huge chunk of your team’s day. These tasks are repetitive, time-consuming, and, honestly, not the best use of your team’s skills.

When your people are stuck in manual mode, there’s less time for the work that really matters to your clients: analyzing risks, identifying trends, and delivering valuable insights.

For your business, this often means higher costs. You need more hours and more resources just to keep up with audit demands. And the more manual work involved, the higher the risk of human error, like missed compliance issues, miscalculated risks, or a data discrepancy slipping through the cracks.

AI-powered auditing tools add value by taking care of manual, repetitive tasks in the auditing process, like data extraction and compliance checks.

The result is faster, more accurate audits with fewer mistakes. And, best of all, your teams can focus on what they do best:

- Assessing risks

- Delivering insights

- Guiding businesses toward better, data-driven decisions.

How AI transforms your auditing process

AI is a practical solution to the real challenges your teams face every day. Here’s how AI makes auditing smarter and more efficient:

- Automates repetitive tasks: Robotic process automation (RPA) handles data entry, organizes documents, and manages compliance checks—taking hours of admin work off your team’s plates.

- Enhances data accuracy: Machine learning algorithms catch inconsistencies in financial data, reducing human error and boosting the reliability of your audit results.

- Speeds up data analysis: Advanced analytics process large datasets in minutes, allowing your teams to analyze complete datasets—not just samples.

- Improves risk assessment: Predictive analytics review historical data, detect unusual patterns, and flag compliance issues before they become bigger problems.

- Strengthens compliance management: AI automatically checks audit findings against regulatory requirements, generating compliance reports and alerting your team to potential issues.

- Boosts fraud detection: AI monitors transactions and system logs in real-time, sending alerts when something looks suspicious.

- Delivers deeper insights: AI turns raw data into clear, visual reports and dashboards, helping your teams quickly spot trends, patterns, and areas of concern.

AI is here to stay. So stay informed.

The second wave of GenAI is here, and it will belong to businesses that make AI a core part of their daily workflows.

Learn where AI can have the biggest impact and how to implement it without disrupting workflows.

Where AI auditing tools make the biggest impact

AI tools can bring real, measurable benefits to four critical stages of your audit process.

Let’s take a closer look at these four stages.

AI

The four stages

- Data collection and preparation

- Sampling and risk assessment

- Fraud detection and compliance checks

- Reporting and documentation

1. Data collection and preparation

Data collection is, frankly, a pain. Auditors request financial records—invoices, bank statements, payroll reports—and they arrive in every format imaginable. What happens next is hours of manual data entry to get everything into a spreadsheet. It’s slow, messy, and leaves too much room for errors.

AI-powered auditing tools can automate the extraction and integration of data. In other words, they can pull data from multiple sources and format it correctly. This transforms messy data into clean, accurate data in minutes (instead of days).

Tools to explore:

- MindBridge AI Auditor: An AI-powered platform that uses machine learning to automate data ingestion, analyze entire datasets for anomalies, and generate ready-to-review audit reports.

- KPMG Ignite: An AI-powered platform that extracts and normalizes data from a variety of documents, saving time and reducing manual errors.

2. Sampling and risk assessment

Traditional sampling is a bit of a gamble. Auditors only review a fraction of transactions, often relying on rules-based assessments like flagging transactions over a certain threshold. The problem is, complex fraud patterns don’t always follow the rules, and human bias can influence which transactions get reviewed.

AI can analyze full datasets, spotting unusual patterns, and prioritizing risks based on real-time insights. Instead of sampling just 5% of transactions, AI helps auditors focus on the most relevant data with greater accuracy.

Tools to explore:

- Deloitte Argus: An AI-based audit tool that analyzes transaction patterns and assesses risks, helping reduce sample sizes while increasing confidence in audit accuracy.

- EY Helix: An audit platform that uses machine learning to identify risk patterns across full datasets, highlighting transactions that need further investigation.

3. Fraud detection and compliance checks

Fraud detection in traditional audits is manual, reactive, and exhausting. Auditors go line-by-line, looking for inconsistencies and relying on experience-based judgment. Compliance checks often involve reading long financial reports and regulations, which is just as time-consuming.

AI can streamline this process by automating anomaly detection and using predictive analytics to identify fraud and compliance risks early. That means auditors can focus on investigating flagged risks and validating findings.

Tools to explore:

- ComplyAdvantage: Monitors transactions and detects compliance risks automatically using AI.

- IBM Watson: An AI and data platform that analyzes documents and financial data to highlight compliance issues and potential fraud scenarios.

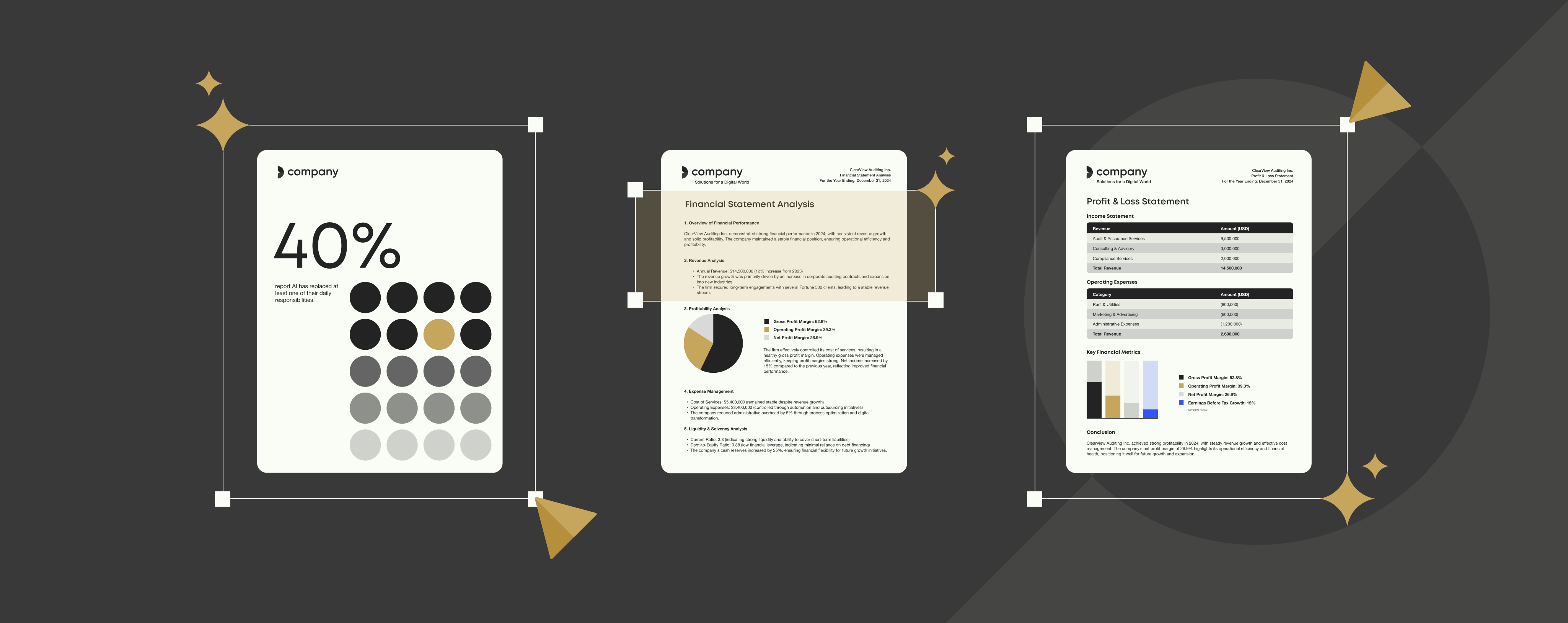

4. Reporting and documentation

Audit reporting is often a time-consuming and fragmented process. Findings need to be compiled, legal disclosures double-checked, and compliance wording perfected. Supporting evidence is often scattered across emails, spreadsheets, and PDFs, which slows down regulatory reviews and makes audits harder than they need to be.

AI-driven tools can help by automatically generating reports, standardizing documentation, and centralizing supporting evidence. Instead of manually formatting documents and revising reports multiple times, auditors can produce consistent, compliant reports quickly and with fewer errors.

Tools to explore:

- Templafy: An AI and automation platform that automates and standardizes the creation of documents, like audit reports, proposals, and pitch decks, to keep them on-brand, compliant, and correctly formatted.

- DocuSign: Manages electronic signatures and document verification, helping to finalize reports and maintain secure audit trails.

Smoother workflows, happier clients

Find out how Templafy generates accurate and compliant proposals, letters, and reports 30% faster with automation and managed AI.

How to keep AI-powered auditing safe and compliant

Rolling out AI auditing tools isn’t just about choosing a software and setting it loose. It involves a careful balance of regulatory compliance, ethical considerations, and strategic governance. The goal is to harness AI’s power while maintaining the integrity, transparency, and accountability that define good auditing practices.

Why do accounting teams need guardrails around their AI?

You work in a highly regulated environment where accuracy, consistency, and trust are non-negotiable. Without clear guidelines and frameworks, adopting AI could lead to compliance breaches, data misuse, and unintended biases.

That’s why it’s critical to ensure that your AI tools align with international auditing standards and data protection regulations from day one. Here’s how you can keep up with regulatory standards.

Regulation and standards to consider

These following guidelines will help ensure your operations remain robust, reliable, and aligned with industry best practices:

- International standards: Make sure your AI auditing practices comply with IFRS (International Financial Reporting Standards) and GAAP (Generally Accepted Accounting Principles). This includes maintaining transparency in financial reporting, ensuring consistency in audit methodologies, and adhering to globally recognized accounting principles.

- Data protection regulations: Adhere to GDPR, CCPA, and other data privacy laws. Since your teams handle sensitive financial information, your AI tools must process data securely, implement data minimization practices, and ensure data is encrypted both at rest and in transit. Establishing clear data governance policies will help manage access and reduce the risk of breaches.

- AI ethics frameworks: Follow established principles from organizations like the OECD and European Commission, focusing on transparency, fairness, and accountability. Prioritize explainable AI, where the decision-making process of AI tools is clear and understandable, and regularly assess AI models to prevent bias and discrimination in audit outcomes.

- Audit quality standards: Align with standards set by the International Auditing and Assurance Standards Board (IAASB) and the Public Company Accounting Oversight Board (PCAOB). This includes ensuring AI tools enhance rather than replace the professional judgment of auditors, maintaining audit quality, and supporting evidence-based decision-making.

- Security and risk management: Implement robust security measures, including multi-factor authentication, regular software updates, and proactive threat monitoring. Develop a risk management framework to evaluate the potential risks associated with AI tools, including data privacy, compliance, and operational risks.

Best practices for responsible AI adoption in auditing

Choosing the right AI tool is only part of the equation. Establishing best practices ensures your team uses AI responsibly and effectively throughout the auditing process. Here are some key habits to build into your workflow:

- Transparency: Clearly document how your AI tools arrive at their conclusions, including the data sources, algorithms used, and the reasoning behind specific outputs. This helps auditors and stakeholders understand the AI’s decision-making process and ensures that findings are explainable and justifiable.

- Accountability: Set up governance structures to oversee AI use, assigning specific roles and responsibilities for managing AI systems. Establish protocols for monitoring AI performance, handling exceptions, and addressing any potential biases or inaccuracies in the AI’s analysis.

- Accuracy: Regularly cross-check AI-generated insights with manual reviews to validate results. Implement a quality assurance process that includes sample testing, anomaly detection, and periodic recalibration of AI models to maintain high standards of audit quality.

- Data integrity: Ensure the data fed into AI systems is clean, complete, and free from biases. Regularly update datasets to reflect the most current and relevant information, reducing the risk of outdated or misleading insights.

- Ethical considerations: Apply ethical frameworks to guide AI use, including fairness, accountability, and transparency (FAT) principles. Regularly audit AI models for biases and ensure they align with your organization’s ethical standards and regulatory requirements.

- Human oversight: AI should support—not replace—the professional judgment of auditors. Maintain a balanced approach where AI handles repetitive tasks, and auditors focus on complex decision-making, analysis, and client interactions.

Why document automation is the perfect starting point

When it comes to automating accounting processes, document automation offers the biggest gains—without the risks that often come with automating more complex accounting tasks.

Templafy is the leading AI-powered document generation platform that makes it easy to create accurate, compliant, and on-brand documents with maximum efficiency. You can access its powerful AI and automation capabilities right from the apps your teams already use, like Microsoft Office, Google Workspace, and Salesforce.

Trusted by industry leaders like KPMG and BDO, Templafy cuts down on repetitive tasks, saving teams over 30% of their time. That’s more time to focus on high-impact, revenue-generating work.

With over 4 million users worldwide, Templafy is redefining how accounting and audit teams create business content—faster, smarter, and with less hassle.

Here’s how:

- Error-free document creation: Automated validation processes catch mistakes before they become costly liabilities, ensuring every document meets strict compliance standards.

- Productivity that delivers results: A Forrester study found that Templafy boosts document and presentation creation speed by 30%, giving your team more time for high-impact, strategic work.

- Cost savings: The Big Four accounting firms reported a 25% reduction in time spent generating audit reports—directly cutting costs and increasing efficiency.

- Enterprise-grade security: With industry-leading security standards, Templafy keeps your documents safe and compliant, even when managing sensitive financial data.

CASE STUDY

How IComm increased its win rate with proposal automation

“We’re getting strong usage from the team because Templafy has helped us reduce our proposal creation from 4 hours down to 20 minutes!”.

Justin O’Meara

Unified Communications Consultant, IComm

Want to find out how KPMG and BDO build faster and more accurate documents with Templafy?

Templafy is all about helping your teams create better documents quickly, so they can focus on the work that really matters.

Getting started is simple—just book an intro call with a Templafy expert, and we’ll guide you through the best solution for your needs.